Quarterly Estimated Tax Payments: Are you paying them? If not, should you be?

KEY TAKEAWAY: If you’re self-employed or have additional sources of income, you may need to make estimated tax payments to the IRS to avoid underpayment penalties. Understanding and adhering to the pay-as-you-go tax system, including making quarterly estimated tax payments if needed, is part of managing your tax obligations effectively and owning your overall financial well-being. Scroll down to the TAKE ACTION section for this week’s actionable steps.

Are you self-employed, working as a freelancer, or have additional sources of income?

Then, you might have to pay estimated tax payments to the IRS. This is especially relevant now as the next quarterly tax estimate deadline — for the third quarter tax payment covering the period June 1 — August 31, 2024 — is September 16, 2024.

What Are Estimated Tax Payments?

Estimated tax payments are payments you make to the Internal Revenue Service or IRS, the US federal tax authority, for the income you earn or receive throughout the year. That is because the US is a pay-as-you-go tax system.¹ In other words, you must pay taxes as you earn or receive income during the year.¹

In general, there are two ways that you can make sure you meet this requirement:²

- One is by having taxes withheld, such as from your paycheck. If you are an employee, your employer probably withholds income tax from your pay. In addition, tax may be withheld from certain other income, such as pensions, bonuses, commissions, and gambling winnings. The amount withheld is paid to the IRS in your name.

- Two, by making estimated tax payments. So, if you don’t pay your taxes through withholdings or don’t pay enough taxes, you can make estimated tax payments.

Note: Depending on where you live, your state may also have tax estimate payment requirements, so be sure to check the rules for your state. Go to your state’s tax authority to learn more.

Who generally needs to make estimated tax payments?

Generally, if you are in business for yourself — for example, if you are a sole proprietor, partner in a business, or S corporation shareholder — you will have to make estimated tax payments if you expect to owe federal taxes of $1,000 or more when your annual tax return is filed.³

Note that C Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.³

You may also need to make estimated tax payments if you receive other income, such as dividends, interest, capital gains, rental income, royalties, alimony, or other monetary prizes or awards that would require taxes to be paid.³

So, do YOU need to make estimated tax payments?

According to the IRS, you generally must make estimated tax payments for the current tax year if both of the following apply:¹

- One, you expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

- Two, you expect your withholding and refundable credits to be less than the smaller of either: 90% of your current year’s tax liability owed, or 100% of your prior year’s tax liability (or 110% if your prior year’s adjusted gross income was over $150,000), where your prior year’s tax return covers all 12 months.

In other words, if you pay throughout the year the smaller of either 90% of your total tax owed for the current year or 100% of the total tax you owed in the prior year (or 110% if your adjusted gross income in the prior year was over $150,000 or $75,000 if you are married filing separately), then you will have met the IRS requirements to pay as you go and avoid underpayment penalties that can be applied when you don’t pay enough.

Note: There are special rules for farmers and fishermen.¹

This is called the Safe Harbor Rule for estimated taxes.

Example: Assume that your total current year tax liability is $20,000, and last year it was $17,000, and you earned less than $150,000. Ninety percent of your current year tax liability would be $20,000 x 90%, which equals $18,000. One hundred percent of your last year’s tax liability is $17,000.

So, as long as you pay the smaller of the two — in this case, $17,000 — throughout the year — whether you do that by having money withheld from your paycheck and/or making estimated tax payments — then you will have met the “safe harbor rule” for estimated tax payments and can avoid underpayment tax penalties.

What happens if you do not pay enough in taxes throughout the year?

If you didn’t pay enough tax throughout the year, either through withholding or by making estimated tax payments or paying too little in estimated tax payments, then underpayment penalties can be charged.

However, there are exceptions to this. For example, the IRS might waive penalties if:⁴

- You didn’t make a required payment because of a casualty event, disaster, or other unusual circumstance, and it would be inequitable to impose the penalty or

- You retired (after reaching age 62) or became disabled during the tax year or in the preceding tax year for which you should have made estimated payments, and the underpayment was due to reasonable cause and not willful neglect.

Furthermore, according to the IRS, you do not have to make estimated tax payments if you meet all three of the following conditions.¹

- You had no tax liability for the prior year

- You were a U.S. citizen or resident alien for the whole year

- Your prior tax year covered a 12-month period

If you are not sure if you’re having enough taxes withheld from what you earn, use the Tax Withholding Estimator to check (link: https://www.irs.gov/individuals/tax-withholding-estimator).

If you want to increase the amount of taxes withheld from your paycheck, you can file a new Form W-4 with your employer.

When do you pay quarterly estimated taxes?

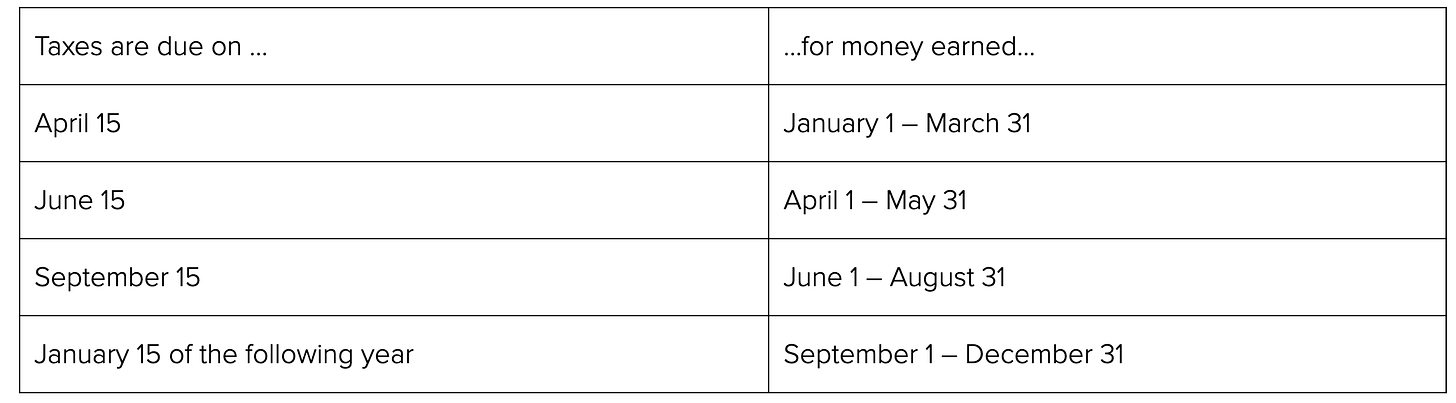

For estimated tax purposes, the year is divided into four payment periods:⁵

However, depending on the day the date falls, these may be adjusted. For example, for the upcoming September deadline, the actual due date is September 16.⁵

Note that if you mail your payment and it is postmarked by the due date, the date of the U.S. postmark is considered the date of payment.⁵

Calculating Your Estimated Tax Payments

As mentioned, you can make estimated tax payments throughout the year based on 100% of your prior year’s tax obligation (or 110% if you are a high earner) or 90% of your current year’s estimated tax obligation.

Method 1: 100% Of Your Prior Year Tax Obligation

Using this method, you would take the amount you owed the previous year, divide that number by 4, and pay that amount for each quarter by the quarterly estimated tax payment due date.

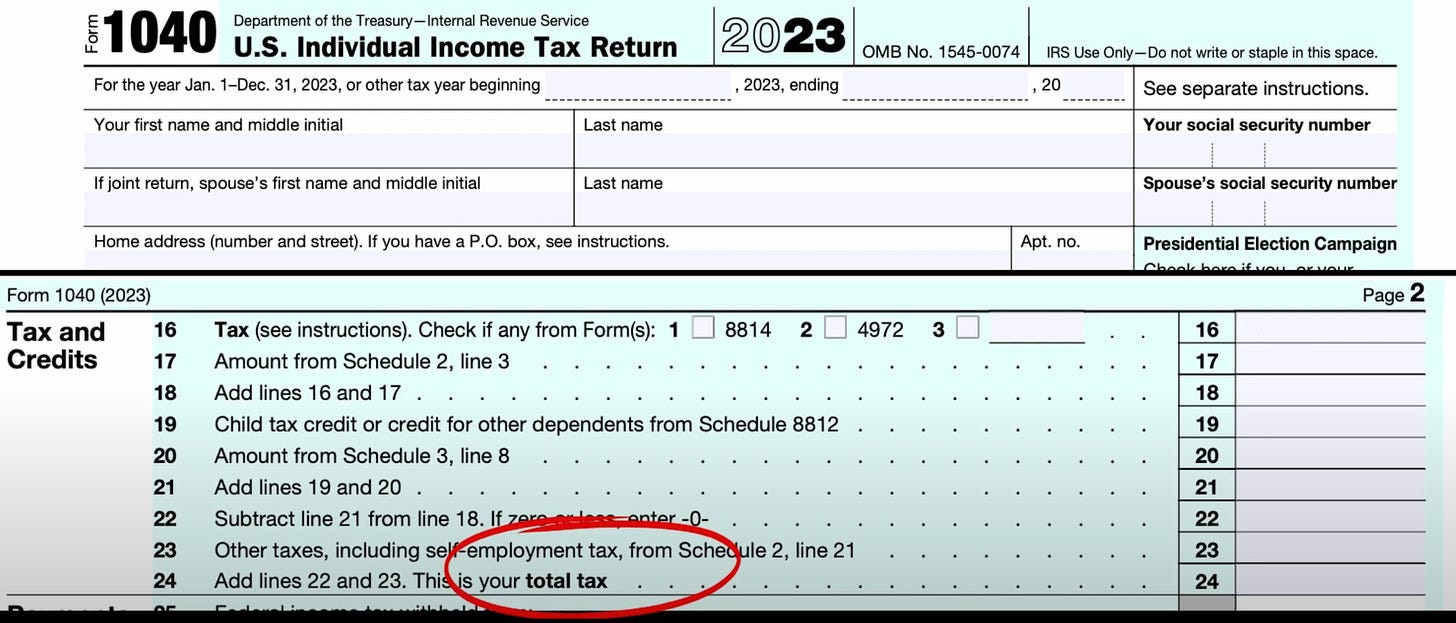

You can find your prior-year tax obligation on your prior-year tax return. Form 1040 is generally on the second page and in the line that says “total tax.”

Example: Sarah is a self-employed graphic designer. Last year, she earned $80,000 in net profit. This year, she expects her business to grow and estimates she’ll earn $90,000 in net profit.

Using Method 1, Sarah would use her prior year’s tax liability to calculate her estimated tax payments. Last year, she paid $20,000 in taxes. Based on her income (which is less than $150,000), she would pay 100% of her prior-year tax liability. Therefore, she would divide the $20,000 by 4 quarters, which would be $5,000. So, Sarah would pay $5,000 in estimated taxes for each quarter for a total of $20,000.

This method is simple and offers safe harbor protection — meaning you are generally protected from underpayment penalties even if your current year’s tax obligation turns out to be higher.

So, why wouldn’t you use this method?

One reason may be that you expect your current year’s tax obligation to be lower than the prior year’s, and you don’t want to overpay in taxes.

Another reason may be that you expect your current year’s income to be much higher than last year’s and, as such, your tax obligation. While some people may choose to still pay estimated taxes based on their prior year taxes — which would still provide safe harbor against underpayment penalties and allow them to keep the additional tax money longer until their annual tax reporting and bill arrives — others may prefer to pay as they go to be as accurate as they can or to avoid having to pay a large tax bill.

Remember: The taxes will still be owed and for some it may be safer for them to pay taxes as they go instead of having to make sure that they have the funds available when the tax bill is due.

If Method 1 is not the best method for you, then you can choose to use Method 2.

Method 2: 90% of Your Current Year Estimated Tax Obligation

Using this method, you estimate what you expect your current year’s annual tax liability will be, divide by four, and pay that quarterly amount throughout the year when estimated tax payments are due.

To estimate your current year tax obligation, you can:

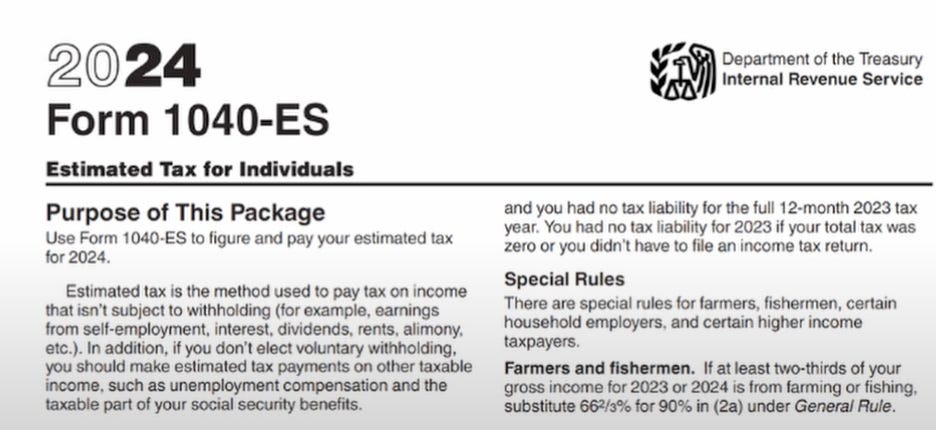

- Use the IRS Form 1040-ES to show your income estimate and project your tax liability.

- Use a simple online calculator, such as the one that AARP provides.

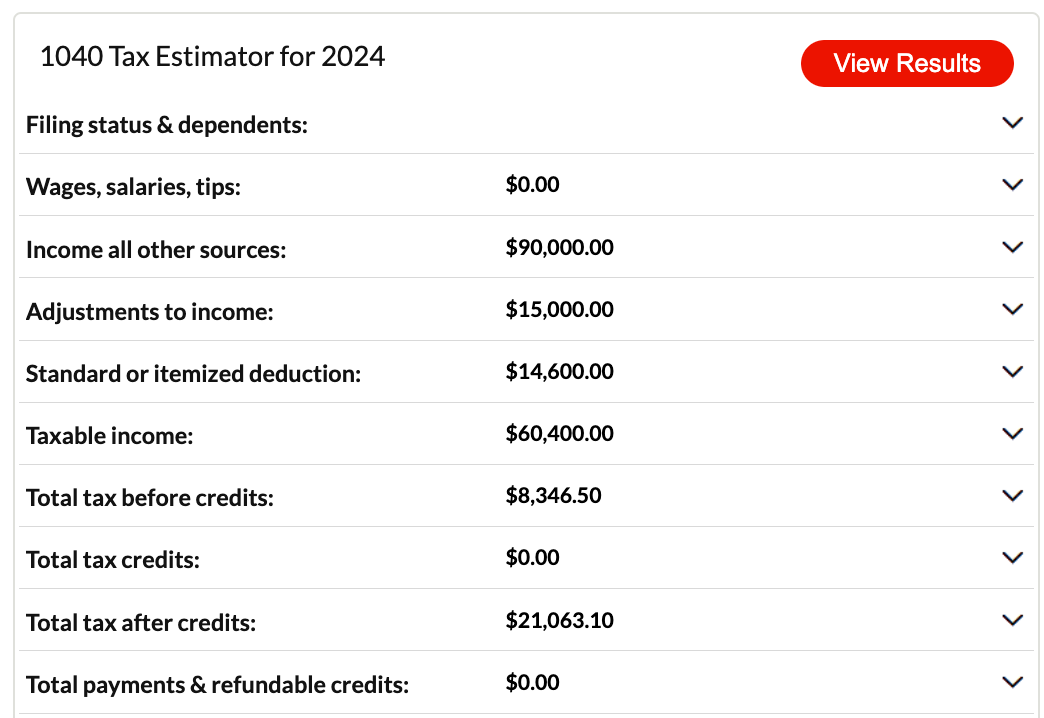

Example: As mentioned, Sarah is a self-employed graphic designer, and this year she expects her business to grow and estimates she’ll earn $90,000 in net profit. Using the AARP online calculator, Sarah’s current year estimated tax obligation is $21,063, which is her estimated income tax of $8,346.50 plus her estimated self-employment tax of $12,716.60, which is the taxes she pays for Social Security and Medicare.

To calculate her quarterly estimated tax payments, Sarah would take her estimated total tax obligation of $21,063.10 and multiply it by 90%, which would be $18,956.79, or rounding up, $19,000. Then, she would divide that by 4, which would be $4,750.

Note that if Sarah wanted to err on the safe side, she could pay 100% of her current-year estimated tax obligation or the full $21,063.10, which, if divided by 4, would be about $5,266.

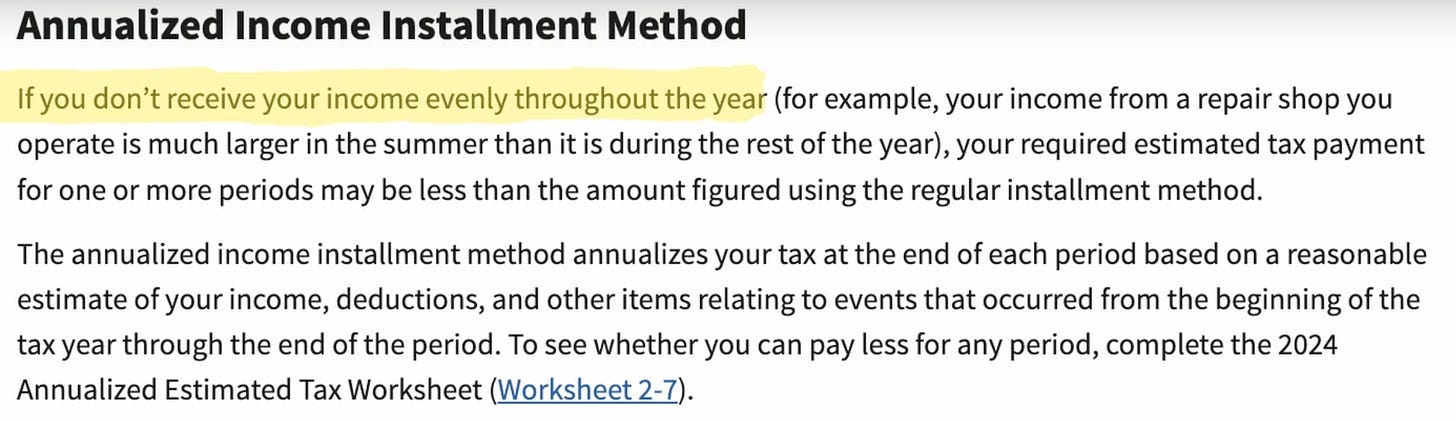

The Annualized Income Method

The above methods will work for many people, but there are exceptions. For example, what if you are paying estimated taxes based on your current year’s taxes, and your income fluctuates a lot during the year?

There is another method, the Annualized Income Method, that can help with this. You basically make estimated quarterly payments based on the income earned for each period:

Source: https://www.irs.gov/publications/p505#en_US_2025_publink1000194669

If this sounds like a better fit for your situation, a good resource is the IRS’s Publication 505.

In addition to the information here and other resources available online, in particular, on the IRS website (see the reference section below for links to cited information), you can also choose to get support from a tax professional, such as a CPA (Certified Public Accountant) who can help you calculate your estimated taxes, as well as help you prepare your annual tax return and tax planning in general.

How to Pay Your Estimated Taxes

For Federal estimated taxes, you can choose to pay in the following ways:

- Send your payments with Form 1040-ES, which shows your tax estimate calculation, by mail.

- Pay online, which is my preferred method. You can also pay through your online accounts, where you can see your payment history and other tax records.

- Pay by phone from your mobile device using the IRS2Go app.

Go to IRS.gov/payments to view all the options and for more information.

Final Thoughts

Taxes may not be the most exciting topic, but they are necessary and part of owning your overall financial well-being. Making sure you are paying enough taxes throughout the year as you earn or receive income is a part of that. After all, while ignorance may be bliss for certain things in our lives, that is generally not the case when it comes to money and taxes, in particular.

So, as part of owning your financial well-being, be proactive when it comes to your taxes, including making sure to meet your pay-as-you-go tax obligations. And, remember: If you need help, get it. Reach out to a tax professional if you want more support in this area. After all, you don’t need to manage everything on your own, but you do need to manage your tax obligations.

TAKE ACTION:

- Determine if you need to make estimated tax payments.

- Identify how best to meet your pay-as-you-go tax obligations, whether that is to increase your tax withholdings or to make estimated tax payments using one of the Safe Harbor estimated tax guidelines.

- Pay your estimated taxes on time, choosing one of the payment options offered by the IRS.gov.

- If you would like more support or have a more complex information, considering seeking the help of a tax professional, such as a CPA.

- Stay informed and keep up-to-date on your tax obligations, including using the resources available on the IRS.gov website.

- Check your state requirements. Verify if your state requires estimated tax payments and follow the specific rules for it.

REFERENCES:

1: IRS.gov. Estimated Taxes. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

2: IRS.gov. Retrieved from https://www.irs.gov/payments/pay-as-you-go-so-you-wont-owe-a-guide-to-withholding-estimated-taxes-and-ways-to-avoid-the-estimated-tax-penalty

3: IRS.gov. Tax Estimates. Retrieved from https://www.irs.gov/faqs/estimated-tax#:~:text=You won’t owe an,you owe at that time and https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes and https://www.irs.gov/faqs/estimated-tax/large-gains-lump-sum-distributions-etc/large-gains-lump-sum-distributions-etc

4: IRS.gov. Retrieved from https://www.irs.gov/taxtopics/tc306

5: IRS.gov. Retrieved from https://www.irs.gov/payments/pay-as-you-go-so-you-wont-owe-a-guide-to-withholding-estimated-taxes-and-ways-to-avoid-the-estimated-tax-penalty

Resource: IRS.gov. Publication 505 (2024), Tax Withholding and Estimated Tax. Retrieved from https://www.irs.gov/publications/p505

IMPORTANT: The information provided is for educational and informational purposes only. It is not intended to be a substitute for professional advice, diagnosis, or treatment. Always seek the advice of a qualified professional with any questions you may have regarding the topics discussed here as the topics discussed are based on general principles and may not be applicable to every individual.

Leave a Comment below: Any insights, experiences or comments you’d like to share on this topic? I’d love to hear from you. Just hit “Comment” and share away!

Inspiration & information delivered to your inbox.

Receive FREE information, inspiration & support to help you feel more fulfilled, energized, and financially empowered in your life. Unsubscribe at any time.

0 Comments