What Causes Inflation & How to Manage It

KEY TAKEAWAY: Inflation, the rate at which prices rise over time, directly impacts consumers by eroding purchasing power, increasing borrowing costs, and influencing savings and investments. It is measured through the Consumer Price Index (CPI) and driven by factors like supply-demand imbalances, production costs, and policy decisions. To mitigate its effects, individuals can manage cash flow, minimize the cost of debt, and explore inflation-resistant investments while adjusting financial plans to safeguard long-term goals. Scroll down to the TAKE ACTION section for this week’s actionable steps.

Inflation has received a lot of attention of late, and for a good cause since—and this you probably know because you’ve experienced it firsthand—it has far-reaching impacts on consumers and the economy.

So, what is inflation, how is it measured, what causes it, why does it matter to you, and how can you reduce its impacts on you and your finances?

What Is Inflation?

Inflation is the rate at which prices of goods and services increase over a period of time. The most recent inflation reading showed that the inflation rate as of September 2024 for the previous 12 months was 2.4%, and if you exclude food and energy, it was 3.3%.¹

How is inflation measured?

There are different measures used to gauge inflation, but the measure I just mentioned and is the one you have probably heard about the most is the Consumer Price Index, or to be specific, the Consumer Price Index for All Urban Consumers or CPI-U, which is calculated by the U.S. Bureau of Labor Statistics (or BLS) using a representative basket of goods and services to determine the monthly change in prices paid by U.S. consumers not living in remote areas, or about 93% of the population.¹

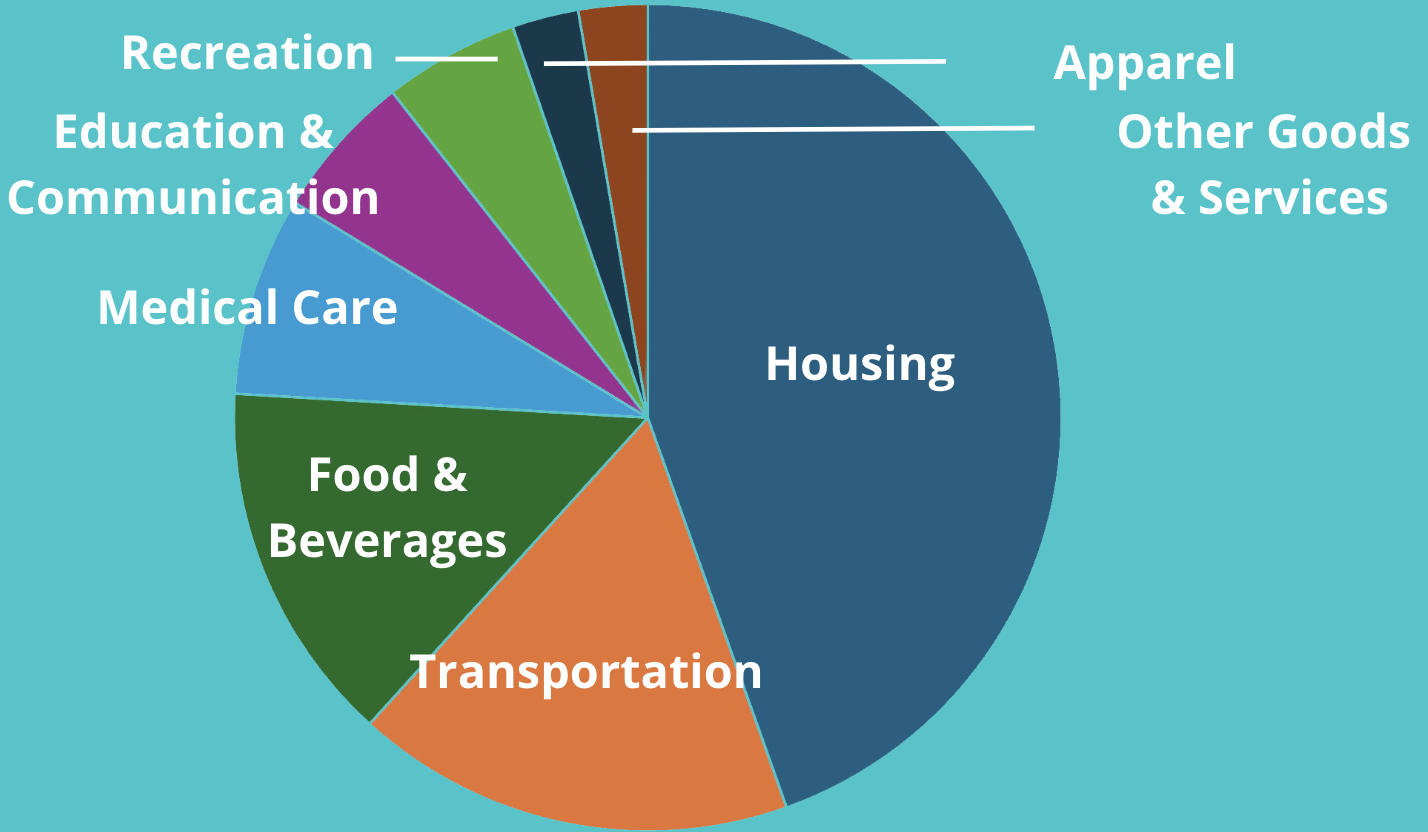

The representative basket of goods and services that is used to determine the monthly change in prices that U.S. consumers pay is based on about 80,000 prices that are gathered monthly from some 23,000 retail and service establishments and cover more than 200 categories of items that are arranged into eight groups which vary in terms of their weight or relative importance in the CPI:¹

What causes inflation?

There are different factors that influence inflation. For example:

- Supply & Demand:¹ When there is an imbalance between supply and demand—where supply is limited or demand for a product or service outpaces the supply for it—prices can go up.

- Policy:¹ When the money supply increases relative to the size of the economy, prices can rise. Government decisions that can increase the money supply include reducing taxes (which can boost consumer spending, which increases demand and can contribute to inflation), lowering the interest rate (which can encourage borrowing and spending, which can increase demand in the economy, leading to inflation), and buying debt, such as treasuries (which can increase the supply of money in the economy, thus influencing inflation).

- Production Costs:¹ When the cost of what is used to produce a good or service increases – such as the prices of raw materials, like oil, or people’s wages—then the prices of the final products also increase.

- Global Factors & Events:¹ Events, such as wars, pandemics (like COVID-19), and natural disasters that disrupt the production of certain goods or raise the cost of production can lead to higher prices. Similarly, factors such as globalization, trade policies, and foreign exchange rates can influence inflation by affecting the cost of imported goods and shaping global economic conditions.

- Expectations:¹ What consumers, businesses, and investors expect in terms of the economy and prices can also influence inflation because it influences decisions made by businesses and consumers around investment, wages, and prices for products.

Why does inflation matter to you?

As you probably have experienced up close and personal, inflation is more than an abstract economic concept; it has a direct effect on you and your lifestyle:

- Inflation impacts your purchasing power: Inflation erodes the value of your money over time because it takes more of your money to buy the same products and goods. A dollar today is worth less in one year. You may have noticed this impact in rising grocery prices, higher utility bills, or higher rent. So, inflation can reduce your ability to afford the same goods and services, which can impact your standard of living. This is especially so if your wages don’t keep up with inflation, something that can be especially relevant for retirees who often live on a fixed income.

- Inflation impacts interest rates and, as such, the cost of borrowing. As we’ve seen and experienced, central banks often raise interest rates to control inflation. This increase makes borrowing—such as getting a mortgage for a home purchase—more costly or can increase the cost of a loan you already have, for example, if you have a loan with a variable interest rate that can go up or down as interest rates change instead of a loan with a fixed rate.

- Inflation affects your savings and investments. If inflation is higher than the interest earned on a savings account, the real value of your savings decreases over time.

Inflation can also impact the economy and affect the returns on different types of investments. Inflation can make it harder to anticipate how certain aspects of the economy may change—such as interest rates, wages, taxes, and profits—and that uncertainty can lead to less activity in the economy, such as businesses adjusting hiring decisions or households reducing their spending, which can ultimately stunt economic growth.

Inflation also affects how you plan for the future. For example, when you plan for retirement, you need to figure inflation into your calculation to determine how much money you’ll need to see you through retirement. Similarly, if you’re planning for your child’s education, you need to factor in the impact of inflation on education-related costs.

So, inflation can affect how you approach saving and investing to preserve and grow your wealth and plan to achieve different financial goals you may have.

How do you mitigate inflation’s effects?

While you can’t predict for certain what inflation will be, there are things you can do to help mitigate the impact of inflation on you and your finances, now and in the future.

Stay On Top of Your Cash Flow

You can protect your purchasing power by regularly reviewing your cash flow, or the amount of money you have coming in and going out, and making adjustments in what you spend money on and how much. For example, you may cut out some non-essential expenses, do comparison shopping to get the best prices, use coupons or discount apps to help reduce the price of products or services you need, or, where possible, try to negotiate or lock in prices.

You can also make sure to minimize the amount of money going out by managing your taxes as efficiently as possible. For example, by making retirement contributions to a tax-deferred retirement account, by engaging in tax-loss harvesting to minimize capital gains taxes, or by putting tax-inefficient investments—so ones that generate more taxable income, such as interest or dividends—in tax-advantaged accounts, you can potentially lower your overall tax bill, which can help offset the impact of inflation.

You can protect your purchasing power by being proactive about your wages. For example, negotiate a salary increase, consider developing new skills to increase your value in the job market, which may lead to better-paying opportunities, or consider how you can create multiple income streams, such as doing freelance work or creating a side business.

If you are preparing for retirement, if possible, select retirement benefits that offer cost of living adjustments (COLAs) to ensure your income grows with inflation. Also, consider delaying social security, which can result in higher monthly payments.

Minimize the Cost of Debt

Also related to cash flow, you can try to lower your cost of debt by getting or locking in fixed-rate loans if you think interest rates are likely to rise due to inflation, paying down high-interest debt, such as credit card balances, and refinancing when interest rates are lower or decreasing.

Consider Inflation-Resistant Investments¹

Include in your investments what what can help protect and grow your wealth in inflationary times. For example:

- High-Yield Savings Accounts: Move your savings to accounts offering higher interest rates to help offset the impact of inflation.

- Inflation-resistant Investments: Consider investments that tend to be more inflation-resistant, such as investing in the stock market, which historically has tended to outperform inflation over time. Investing in TIPS (Treasury Inflation-Protected Securities) or I-Bonds are other options. With TIPS, their principal value adjusts based on the Consumer Price Index (CPI) (these can also be purchased in funds, such as an Exchange Traded Fund or ETF), while I-Bonds are government savings bonds (you can purchase these from the TreasuryDirect website) whose interest rate is connected with the inflation rate to help provide a hedge against inflation. Real estate is another investment that tends to keep up with inflation, as are commodities, like oil, gas, and agricultural products, or precious metals, like gold. While commodities tend to have greater price volatility, they also tend to hold or increase their value during inflation.

Keep On Top of Inflation

Monitor inflation and adjust your financial strategies as needed. As part of this, you may want to adjust your rainy day or emergency fund to account for higher living expenses and ensure you’re able to cover the costs of an unexpected expense should one arise. It’s generally recommended that you set aside enough to cover 3 to 6 months’ worth of essential expenses, adjusted as appropriate for your situation.

Final Thoughts

Inflation is more than an abstract economic concept—it has direct effects on your daily expenses, income, savings, and long-term financial goals. While not all inflation is bad—in fact, a certain amount is considered healthy for an economy, generally around 2%—too much, and it can have an impact.

So, while we rely on the government to manage inflation, you can also do your part by understanding how inflation works, keeping abreast of what is happening with inflation, and making informed decisions on how best to mitigate it to safeguard your purchasing power and financial security over time.

TAKE ACTION:

- Understand and monitor inflation.

- Consider how you can adjust your financial strategies to help mitigate the impact of inflation, including managing your cash flow, reducing the cost of debt where you are able to, and considering what inflation-resistant investments would align with your situation and financial goals.

References:

1: Inflation

All Urban Consumers (CPI-U population) and Urban Wage Earners and Clerical Workers (CPI-W population). https://www.bls.gov/cpi/questions-and-answers.htmhttps://www.bls.gov/cpi/factsheets/motor-fuel.htm#:

Fidelity.com. https://www.fidelity.com/learning-center/wealth-management-insights/6-ways-to-help-protect-against-inflation#:

Fulton Bank. 9 ways to reduce the impact of inflation on your wallet. Retrieved from https://www.fultonbank.com/Education-Center/Trending/Ease-the-impact-of-inflation

Investopedia.com. https://www.investopedia.com/articles/investing/081315/9-top-assets-protection-against-inflation.asp#:~:text=produced higher returns.-,6.,an investment portfolio against inflation

Investopedia.com. Fernando, Jason. Consumer Price Index (CPI): What It Is and How It’s Used. https://www.investopedia.com/terms/c/consumerpriceindex.asp

Peter G. Peterson Foundation. What is Inflation and Why Does it Matter? https://www.pgpf.org/budget-basics/what-is-inflation-and-why-does-it-matter

TrendScout. https://www.trendscoutuk.com/blog/managing-inflation-risk-for-investors/#:

UNFCU. https://www.unfcu.org/financial-wellness/protect-your-money-during-high-inflation/

U.S. Bureau of Labor Statistics. CPI Index. Table 1 (2021 Weights). Relative importance of components in the Consumer Price Indexes: U.S. city average, December 2022. https://www.bls.gov/cpi/tables/relative-importance/2022.htm

IMPORTANT: The information provided is for educational and informational purposes only. It is not intended to be a substitute for professional advice, diagnosis, or treatment. Always seek the advice of a qualified professional with any questions you may have regarding the topics discussed here as the topics discussed are based on general principles and may not be applicable to every individual.

Leave a Comment below: Any insights, experiences or comments you’d like to share on this topic? I’d love to hear from you. Just hit “Comment” and share away!

Inspiration & information delivered to your inbox.

Receive FREE information, inspiration & support to help you feel more fulfilled, energized, and financially empowered in your life. Unsubscribe at any time.

0 Comments